Treasury bonds as an alternative for investments in 2023

Benefits and Risks of Investing in US Treasury Bonds as a Diversification Option

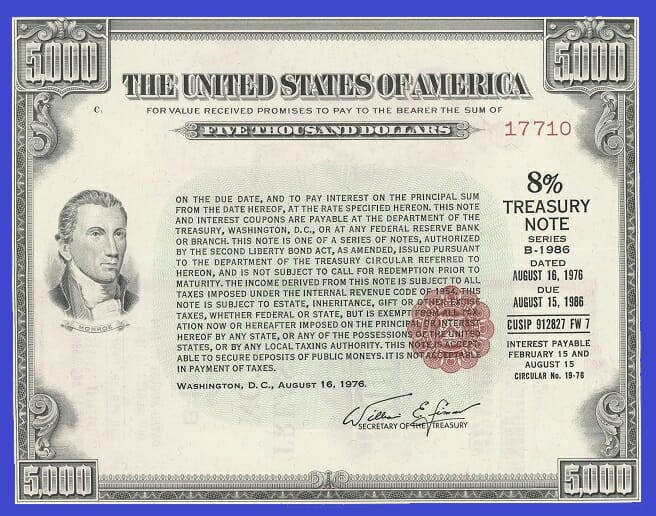

US Federal Bonds, also known as Treasury Bonds, are a type of debt security issued by the United States government. These bonds are considered to be among the safest investments available, as they are backed by the full faith and credit of the US government.

Treasury bonds have a maturity of more than 10 years, and they pay a fixed rate of interest, which is paid semi-annually. When you purchase a Treasury bond, you are effectively lending money to the US government, and you will receive regular interest payments until the bond reaches maturity, at which point you will receive the principal amount you invested back.

Investing in Treasury bonds is a popular way for individuals to save for the long-term and to diversify their portfolios, as they offer a low-risk investment option with a relatively stable return. They are also often used by institutions and governments as a benchmark for other investments, such as corporate bonds or municipal bonds.

It's important to note that, like all investments, Treasury bonds carry some risks. For example, the value of Treasury bonds may be impacted by changes in interest rates or economic conditions, and there is also a risk of inflation eroding the purchasing power of the interest and principal payments over time.

when we facing for 2023's interest rates and inflation :

When interest rates are high, the yield on new Treasury bonds will also be higher, making them more attractive to investors. This can increase demand for Treasury bonds, which can drive up their price.

However, it's important to note that high interest rates can also have a negative impact on the value of existing Treasury bonds. This is because when interest rates rise, the value of previously issued bonds, which have lower yields, will decrease. This is known as "interest rate risk".

In general, when interest rates are high, the value of long-term Treasury bonds may be more sensitive to changes in interest rates, compared to short-term Treasury bonds. This is because long-term bonds have a longer time until maturity, and therefore, are exposed to interest rate risk for a longer period.

If you already own Treasury bonds, a rise in interest rates can result in a decline in the value of your bonds.

2023's Inflation -

Treasury bonds can be a suitable investment channel for those looking to protect against inflation. This is because Treasury bonds are issued by the U.S. government, and their principal and interest payments are guaranteed.

In times of high inflation, the yield on Treasury bonds may increase, as investors demand a higher return to compensate for the decline in purchasing power of the money they receive in interest and principal payments. This can make Treasury bonds more attractive to investors, and can help to drive up their price.

However, it's important to remember that the impact of inflation on Treasury bonds can be complex, and can depend on a number of factors such as the rate of inflation, the level of interest rates, and the overall economic conditions.

For example, if inflation is high and the Federal Reserve raises interest rates to curb it, this can have a negative impact on Treasury bond prices, as the yields on new bonds will be higher, making them more attractive to investors and decreasing demand for existing bonds.

Read More

-

NLR ETF at $145.21: Uranium, Nuclear Power and the AI Baseline Energy Trade

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Demand Lifts XRPI, XRPR and Bitwise XRP as XRP-USD Defends $2.10 Support

14.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward $3 as Warm Winter Clashes With LNG Demand

14.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Climbs Toward 160 as Japan’s Debt Fears Clash With BoJ Hike Hopes

14.01.2026 · TradingNEWS ArchiveForex